Digitaliza y sistematiza el proceso de vigilancia e ideación para facilitar la toma de decisiones estratégicas.

Disponemos de una metodología y un software propio llamado InTool, con el que te acompañaremos a conseguir tus objetivos ahorrando tiempo y recursos.

Consigue un flujo de información de calidad y gestionable con un proceso definido y claro.

Fomenta la colaboración al compartir y crear conocimiento juntos.

Te ofrecemos una forma más eficaz de llevar adelante la captura, gestión, difusión y explotación de la información. Contáctanos ahora.

Servicios

Trabajamos contigo para convertir la información en soluciones y estrategias.

¿Cómo te ayudamos?

Vigilancia e ideación

Desde la captación de información hasta la generación de ideas

Te acompañamos a implementar un sistema que recopila información estratégica de manera automática, fácil de manejar y la distribuye a diferentes niveles dentro de la organización. Este flujo de información nos lleva a colaborar en la creación de nuevos proyectos alineados con la estrategia de la empresa.

Exploración de oportunidades

Transformación de las ideas en proyectos y oportunidades

Analizamos las ideas y comenzamos un proceso de aceleración para aquellas propuestas seleccionadas, llevando a cabo una evaluación rápida en el mercado y estableciendo un modelo de negocio viable.

¿Quieres más información acerca de los servicios o lo que hacemos?

Contacta con el equipo de InToolCAPACITACIÓN

Formación

Ofrecemos sesiones formativas para ayudar a comprender lo que significan las dinámicas de innovación basadas en la vigilancia e inteligencia.

VALOR AÑADIDO

Metodología

Gracias a ella, conseguimos integrar en la dinámica actual de la organización rutinas de vigilancia transversal que nos ayudan a generar conocimiento.

La herramienta

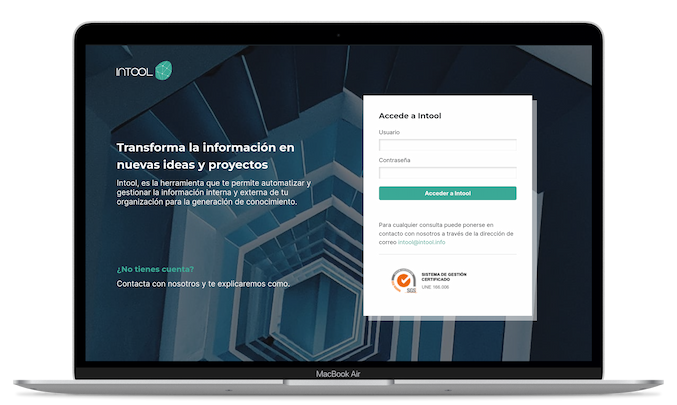

InTool es una herramienta de vigilancia e ideación que hemos creado para responder a los retos y objetivos de innovación de todas las áreas de tu organización.

Flujo de información relevante y gestionable

Software para la gestión del conocimiento e innovación desarrollado para automatizar y gestionar la información interna y externa de tu organización.

TESTIMONIOS

Quiénes somos

Somos una empresa que ofrece servicios de vigilancia e ideación que favorecen la innovación y la toma de decisiones estratégicas en tu organización. Para ello contamos con una metodología propia que hemos desarrollado gracias a la experiencia adquirida desde el año 2008 acompañando a las empresas a implantar sistemas de vigilancia e ideación. ¿Innovamos juntos?

Ver más >>

Contacta con nosotros

Xemein Etorbidea, 12-A

Lea-Artibai Berrikuntza Gunea

Markina Xemein (BIZKAIA)

Lea-Artibai Berrikuntza Gunea

Markina Xemein (BIZKAIA)